Overcoming eCommerce Finance Challenges in 2024

See those customers flock to your online store? They pore over your digital catalog and make online purchases? Of course, you rejoice at the idea of seeing your sales skyrocketing! That’s how eCommerce rewards online sellers these days.

This doesn’t mean, however, that you’ll not be bombarded with financial challenges. Despite the boost in profits, you’ve got to be aggressive with your product promotion.

Don’t worry, as eCommerce tips and tricks can kick your sales up a notch. But aside from augmenting your profits, you also have to cut your expenditures.

So, let’s ask the most pressing question in eCommerce:

How do you overcome the financial challenges in 2024?

Read on to find out the answer to this question.

How To Overcome Financial Challenges in eCommerce for 2024

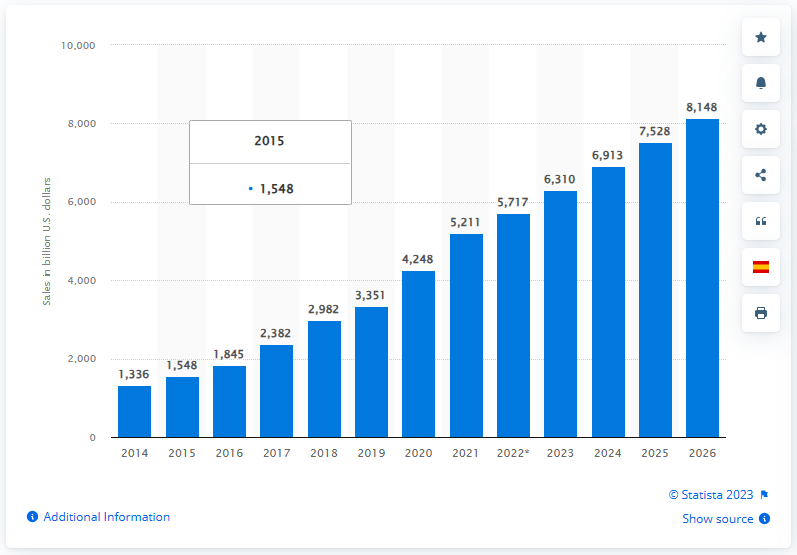

The pandemic outbreak has triggered the boom in eCommerce. Now, this market has been exponentially growing and expanding. The numbers from Statista never lie:

The global eCommerce sales is poised to grow from $5.2 trillion in 2021 to $8.1 trillion in 2026. What a potential increase of over 55% in the next few years!

Given its market growth, now is the right time to dive into the world of eCommerce. But if your online store has been up and running, you’ve got to stay on top of your finances. Chances are that you’ve encountered several financial challenges in the past few years. What more in the year to come!

So, how do you rise above these challenges in 2024? Good question! Here are some financial tips for your eCommerce business:

Market your offers but serve your masters

As an online seller, you have one ultimate goal: satisfy customers and make more money. This means you’ve got to focus on two key aspects: marketing and customer service. That way, you won’t experience financial struggles next year and beyond.

There are various eCommerce digital marketing tactics that truly work:

- Consider pay-per-click advertising (PPC) and search engine optimization (SEO) for product visibility and site traffic.

- Resort to email outreach, content marketing, and social media management for customer engagement, lead generation, and sales conversion.

However, the work doesn’t stop there. Jerry Han, CMO at PrizeRebel, suggests prioritizing customer service.

Han said, “Always put your customers at the top to increase your bottom line. Create a seamless customer journey, personalize their experience, and suffice their needs. Ultimately, happy campers won’t only buy your products but will patronize your brand for good.”

Keep an eye on your eCommerce cash flow

Did you know financial business success isn’t just about increasing your sales or selling internationally? What if you have a boost in sales but lots of expenses as well? And the worst thing is that you spend more than you earn in your eCommerce business. A recipe for a business disaster!

That said, maintaining a consistent cash flow is key. But wondering how it works? The rule is simple:

- Strike a balance between your income and expenses

- Earn more than you spend on your click-and-order store.

Jim Pendergast, Senior Vice President at altLINE Sobanco, recommends managing your cash flow very well.

Pendergast said, “Track all your expenditures and compare them with your monthly profits. While you try your best to promote your brand and sell your products, consider cutting unnecessary costs. The trick of the trade for financial success? More income, less expenses!”

Stay on top of your eCommerce inventory and payment processing

Balancing income and expenses? There are two things you better look at: inventory and payments.

When asked what specific eCommerce operations to manage, Tom Golubovich, Head of Marketing & Media Relations at Ninja Transfers, suggests the abovementioned. “While your inventory levels can determine your expenditures, your payment collections will impact your eCommerce profits.”

That said, Golubovich highlights the following for your eCommerce business:

- eCommerce Inventory: This process includes everything your business needs, from raw materials to finished products. Even parts and components vital to your eCommerce operations fall under this. That said, regulate your inventory levels so that you won’t run out of stock, nor will you overstock on your eCommerce business.

- Payment Collection: This process can significantly impact your business profits. What better way to manage your payment collection than to provide your customers with seamless payment processing? Offer them different payment solutions for goods or items, such as digital wallets and crypto options, on top of the regulars like debit and credit cards.

Rub elbows with cost-effective partners

Shawn Plummer, CEO of The Annuity Expert, suggests partnering with cost-effective providers to manage your eCommerce finances.

Plummer said, “As an eCommerce business, you might work with third-party providers or external vendors to oversee some of your operations. Know that they can add up to your overall expenditures. The key here is to look for highly reliable yet affordable partners.”

Below are the stakeholders you might partner with for your eCommerce business:

- Suppliers: They are responsible for providing you with the raw materials or the products themselves on a consistent basis. Consider working with local vendors at a cheaper cost without compromising quality!

- Warehouse Facility: The warehouse is where you’ll keep your stocks. While you want to ensure your product safety, consider how you can save up in the long run. Either you build your own warehouse or work with a cost-effective facility to house your goods or items.

- Shipping Provider: You might also work with shipping or trucking companies for your product delivery. Why not invest in a fleet of vehicles or partner with a more affordable courier?

Outsource to the other side of the globe

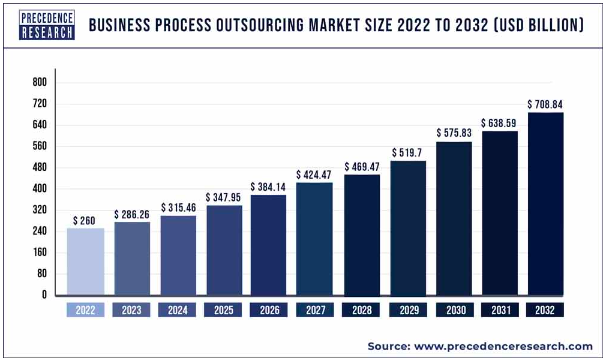

Outsourcing has become all the rage due to globalization and technological advancements. Take it from the Precedence Research:

The business process outsourcing (BPO) market is poised to achieve a 10.60% CAGR. Why not? This market could possibly hit $708.84 billion by 2030 from only $260 billion in 2022.

According to Outsource Accelerator, outsourcing can help you save money by up to 70%. Here’s the good news: The BPO sector has penetrated the eCommerce market. That said, you can outsource the following eCommerce functions:

- Supply Chain: You can hire a back-end text recruiting on the other side of the globe. This team will oversee the flow of your products. It starts with your suppliers to products getting stored in the warehouse, all the way to your customers’ doorsteps.

- Order Fulfillment: You can employ an outsourced team to process orders placed by customers online. They’ll reach out to the back-end team to pick, pack, and deliver the ordered products. The end goal? Ensure these products reach the customers on time and in a safe manner.

- Customer Service: You can work with a BPO team that can make your customers feel truly special. They can take on tasks, such as product inquiries, order updates, customer complaints, as well as product returns and refunds. Remember, the goal is to make these customers fully satisfied and genuinely happy with your products and services!

Anthony Martin, Founder and CEO of Choice Mutual, cites the cost-savings benefit of outsourcing.

Martin said, “Working with service providers on the other side of the globe is a lot more affordable. At the same time, these BPO providers are very efficient and reliable. They can make a difference in your eCommerce business in terms of cost-effectiveness.”

Prepare for what lies ahead with a contingency plan

No matter how financially prepared your eCommerce business is, emergencies can strike anytime. What better way to mitigate and minimize the financial risk than to implement a contingency plan? Here’s how:

- Establish a contingency team. Of course, build a solid team responsible for taking planned measures in case of an emergency. You might want to take the lead if you run a small eCommerce business. However, the goal is to plan and prepare for potential disruptions.

- Set an emergency fund in place. Whether on a personal or business level, setting aside money for emergency cases is imperative. That way, when the disruption happens, you can maintain your business cash flow and ensure continuous eCommerce operations.

- Have disaster recovery measures. Remember the pandemic outbreak where many businesses were caught off guard? Learn from several online stores, which have managed to survive and continue to thrive today. The lesson? Have disaster recovery measures to prepare for natural calamities, possible cyberattacks, or even a global recession.

Bruce (Mingchen) Chi, CEO of SuretyNow, suggests setting a contingency plan for your eCommerce business. Chi said, “As disasters and disruptions are inevitable in business, you must plan on how to withstand any storm coming your way. For example, consider getting a surety bond to pay for your contractors should your eCommerce business face financial shortcomings. In the end, it’s better to be prepared than sorry.”

Work with the experts in crunching numbers

As an eCommerce entrepreneur, you might know the ins and outs of the industry. You are on top of keeping your business afloat. However, it takes working with professionals who can balance your income and expenses.

That said, consider hiring the following:

- Bookkeepers: Bookkeeping is as simple as recording all your financial transactions in eCommerce. See what comes in and goes out of your bank account? A professional bookkeeper will track them all accurately and completely!

- Accountants: While bookkeeping is mere recording, accounting goes beyond that. It extends to financial reporting, data analysis, and business forecasting. An accounting professional can regulate your eCommerce cash flow and help you make informed business decisions.

- Tax Specialists: You shouldn’t miss out on your tax obligations, whether sales tax or income tax. However, tax recording, filing, and reporting can be tedious and daunting. A professional tax specialist can help you fulfill your tax obligations to avoid hefty fines and legal consequences.

Andrew Pierce, CEO at LLC Attorney, recommends working with professionals for legal and financial protection. Pierce said, “Bookkeepers and accountants can help record, track, analyze, and manage finances. They can maintain a steady cash flow for your eCommerce business. Meanwhile, a tax specialist can help you meet your tax obligations. That way, you won’t be subject to legal implications and hefty penalties.”

Final Words

The eCommerce industry has got you covered as an entrepreneur. This sector offers you plenty of business opportunities, and its platforms are where the consumers now live and breathe. It’s safe to say that eCommerce will continue to help you make more and more money.

However, the eCommerce industry comes with financial challenges, as experienced by online sellers. Think of the supply chain disruptions, industry competition, highly critical consumers, and more. As such, consider the practical tips recommended above for overcoming the financial obstacles in your eCommerce business.

Heed our advice on how to rise above the financial challenges, and you’ll be on your way to eCommerce success next year and beyond!